Introduction

Insurance costs are a significant burden for fleet operators, but what if you could dramatically reduce those expenses while improving safety? Vehicle Cameras are revolutionizing fleet management by offering real-time monitoring, evidence collection, and driver accountability. In this article, we’ll explore how vehicle cameras help lower insurance premiums and ensure safer roads. We’ll also showcase the advanced features of the 1/3 CMOS Vehicle Camera System, a powerful solution for modern fleets.

Why Insurance Companies Love Vehicle Cameras

Insurance providers increasingly recognize the value of vehicle cameras in preventing accidents and resolving claims. Here’s why:

- Accident Evidence: Cameras provide irrefutable evidence, protecting fleet operators from fraudulent claims and legal disputes.

- Risk Reduction: By monitoring driver behavior, cameras help prevent accidents, lowering the risk profile of fleets.

- Cost Savings: Reduced accident rates and quicker claim resolutions translate to lower insurance premiums.

To dive deeper into how vehicle cameras impact insurance, explore this informative article.

Features That Matter: The 1/3 CMOS Vehicle Camera System

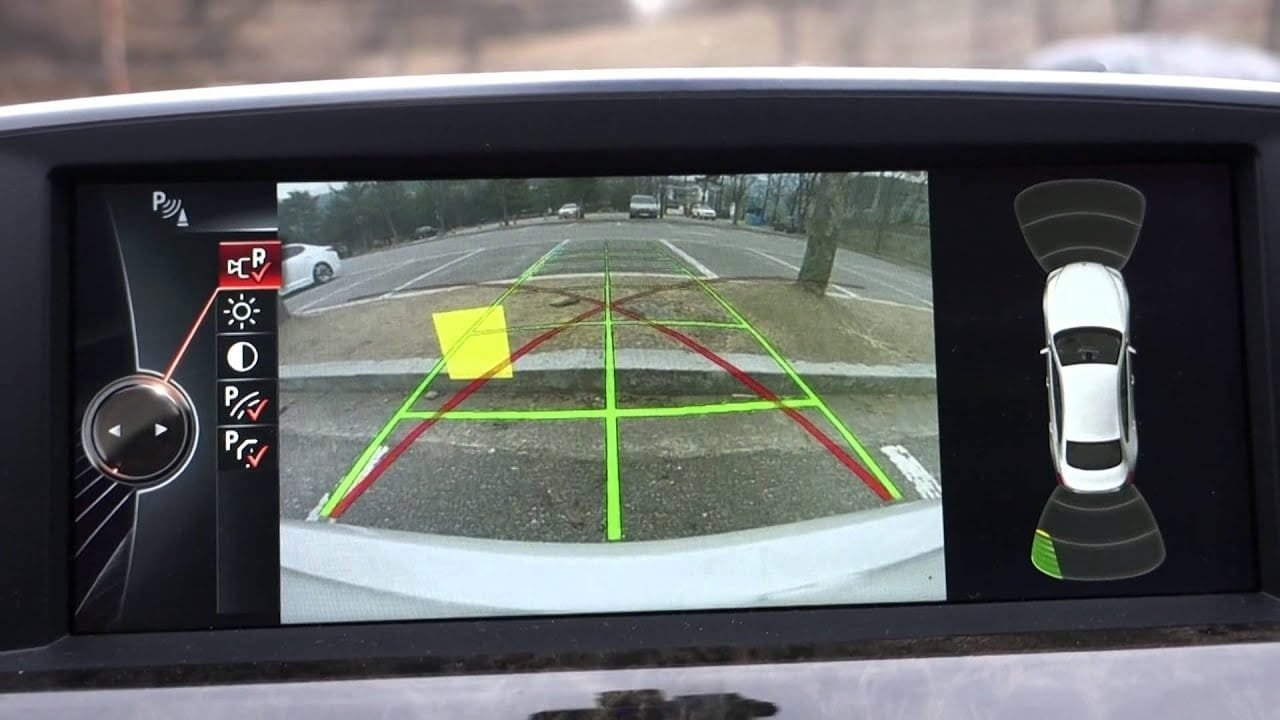

The 1/3 CMOS Vehicle Camera System is an industry-leading solution designed to meet the demands of fleet operators. Here’s what sets it apart:

- High-Resolution Imaging: The 1/3 CMOS sensor delivers crystal-clear video, ensuring every detail is captured.

- Wide Angle Coverage: Provides a comprehensive view of the vehicle’s surroundings, reducing blind spots.

- Night Vision: Ensures reliable performance in low-light conditions for 24/7 monitoring.

- Durable Design: Built to withstand harsh environments, ensuring long-term reliability.

Benefits Beyond Insurance Savings

While reduced insurance costs are a major advantage, vehicle cameras also offer:

- Enhanced Safety: Real-time monitoring and driver alerts help prevent accidents.

- Improved Driver Training: Footage can be used to identify areas for driver improvement and provide targeted training.

- Operational Efficiency: By analyzing routes and driving behaviors, fleet managers can optimize operations and reduce fuel consumption.

Frequently Asked Questions (FAQs)

1. How do vehicle cameras reduce insurance premiums?

By preventing accidents and providing evidence for claims, vehicle cameras lower a fleet’s risk profile, leading to reduced insurance costs.

2. What makes the 1/3 CMOS Vehicle Camera System unique?

Its high-resolution imaging, wide-angle coverage, and night vision capabilities make it a superior choice for modern fleets.

3. Can vehicle cameras improve driver behavior?

Yes, monitoring driver activities encourages accountability and safer driving habits, reducing accident risks.

Conclusion

Vehicle cameras are more than just a tool—they’re an investment in your fleet’s safety and efficiency. With solutions like the 1/3 CMOS Vehicle Camera System, fleet operators can reduce insurance costs, enhance driver performance, and create a safer environment for everyone on the road. Don’t wait—empower your fleet with cutting-edge technology today.